I first published the Money, Life, Retirement series in June 2017. It’s been 4 years since that rather long winded series of posts about life, investing and bad jokes. I’m now a long way towards early retirement and if you put into action some of the things I mentioned 4 years ago I’m sure you are too.

In number 5 of the series How to get where you want? I described my investment approach. Since then my approach has changed a little. I’d like to share what it is now and why.

As a reminder my original investing approach was to save as much money as I could and buy diversified index funds through exchange traded funds (ETFs) such as those offered by Vanguard. Within that approach my intended asset allocation was the following:

| Stocks | Bonds | |

| Australian | 50% | 20% |

| International | 20% | 10% |

The reasons for this were discussed in the original post, link above.

I still maintain that this asset allocation is a good one. Over time I’m sure you would generate a mountain of wealth if you followed it.

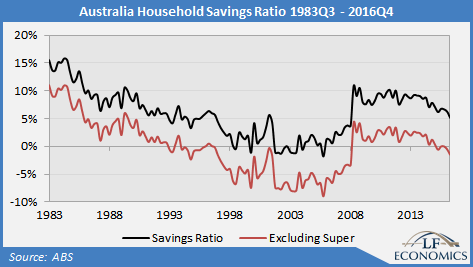

But over time I kept thinking about how franking credits are a free kick in the Australian tax system. Considering that I’m frugal, when I retire I’ll be in a low tax bracket which will mean I get almost all of the franking credits back. That’s bonus cash and really amplifies the dividend yield of Australian stocks. It bumps them generally to above a 5% dividend yield.

I also read a book called Motivated Money by a guy called Peter Thornhill. He’s an old hand at investing who accumulated a really fat wad, somewhere in the order of $8M just working a normal job and regularly investing. His $8M fat wad spits out about $400k in dividend payments per year, which is probably more now (he has a great series of videos here).

He’s a big fan of investing for dividends and pointed out that over time the amount of dividends paid out generally increases at close to twice inflation. This is because generally profitable companies pay out some dividends, but also retain some profits to increase their profitability in the long run. So if you have enough dividends to live on now, in the future that’ll increase to be more and more without doing anything.

He’s also a big fan of Listed Investment Companies (LICs) over index funds. There are a few differences between index funds and listed investment companies:

| Listed Investment Company | Index Fund (ETFs such as VAS and VGS) |

| The number of shares is fixed, so the price per share can move out of sync with Net Tangible Assets (sum of the price of the underlying shares) | There is a “market maker” which creates or destroys shares to keep the price close to the value of the Net Tangible Assets |

| A LIC can hold cash to smooth out dividend payments over time, or for other purposes such as to purchase other companies | Because of the trust structure an index fund must pay out all of the dividends paid by the underlying stocks (as a distribution) |

| LIC’s generally have some kind of active stock picking (however the ones I like are buy and hold investors with almost as much diversification as an index fund) | An index fund replicates an index, is very diversified and doesn’t buy and sell unless stocks move in or out of the index |

Taking all of that into account here is what my approach has now changed to over time:

- Keep an emergency fund that will cover at least 6 months of expenses in a high interest savings account.

You never know what is going to happen. Life is uncertain. The only certainty in life is that it will end. You and your offspring and your offspring’s offspring will eventually be forgotten and the universe will end in homogenous heat death. Emergencies happen, hence you need an Emergency fund.

2. Spread my cash between the following ETF / LICs with the following allocations, so that I receive a roughly equal dividend payment 10 months of the year.

| Group | Stocks | Allocation |

| 1 | VAS | 40% |

| 2 | AFI BKI | 20% |

| 3 | ARG MLT AUI | 20% |

| 4 | WHF | 20% |

Their general payment times are:

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

| VAS | BKI AFI | ARG MLT AUI | VAS | WHF | VAS | BKI AFI | ARG MLT AUI | VAS | WHF |

All of the LICs chosen above:

- have a low management fee

- contain a diversified portfolio of stocks, not as many as an index fund, but almost

- have been around for a really long time (often over 50 years)

- have a strong track record of paying increasing dividends.

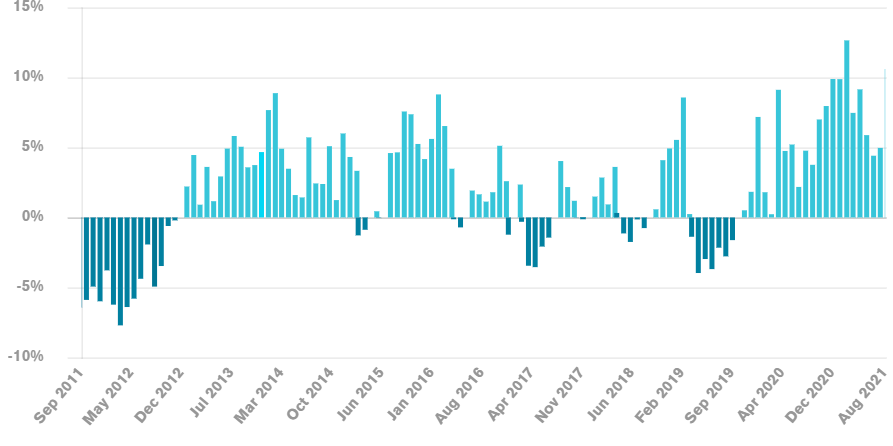

Over time the dividends will grow at a pace faster than inflation. For example AFI over a 24 year period has a CAGR on their dividends of 3.56% vs CPI of 2.45% over the same period, while BKI over a 12 year period had a CAGR on their dividends of 4.16% while CPI was 2.31% over the same period.

Generally during a stock market crash the price of the stocks crashes as the prices have increased to an unsustainable level. However dividends are generally related to company earnings, not stock prices. Earnings don’t have the same mania induced highs and subsequent crashes. So the dividends paid should remain reasonably consistent. To add to this Listed Investment Companies are free to not pay out all of their dividends and to maintain a buffer of cash to smooth out the dividend payments over time. For example in 2008 during the GFC both AFI and BKI still paid (and increased) their dividend.

3. When the LICS are at a discount to NTA, buy them. When they’re not buy VAS.

Listed Investment Companies can often be sold at a price that is a premium or a discount to the sum of the underlying net tangible assets (NTA). The share price can swing between a 10% premium to a 10% discount over time based upon the fickle minds of the investing public. This often means that you can buy what is really a dollar worth of shares for 90 cents. Here’s a graph of the AFI share price to NTA over time. AFI can often be overvalued, since that idiot Barefoot Investor told everyone to buy it in his “book” (long winded sales pitch for his paid investing blueprint newsletter), but the other LICs mentioned more frequently trade at a discount. I made a spreadsheet using the google finance function to track this so I know what is at the greatest discount or premium, which you can use here: NTA Calculator

When no LICs are at a discount and I can’t buy a dollar for 90 cents I buy VAS, which doesn’t fluctuate above or below its NTA.

4. Don’t sell.

If I sell any shares I may trigger a tax event and need to pay capital gains tax. If the shares are paying a steady stream of dividends and I have a nice safety net in the Emergency Fund then there’s no reason to sell. Additionally all of the Listed Investment Companies given above have been around for at least 50 years, have a strong track record of paying ever increasing dividends and there shouldn’t be a need to sell. In the case of recession, they’re well diversified so that they’re effectively a bet on the whole Australian economy. If the whole Australian economy stops, then we all have larger things to worry about than the stock market. At that point it’s time to stop buying shares and to start buying AK47s a LandCruiser and many many cans of baked beans.

5. 100% international stocks in my Superannuation to take a little of the Australian centric risk out of my total investing life.

To make sure I still have some exposure to International stocks I swapped my Super allocation to be 100% international stocks. Many of the Australian companies within the shares above sell things overseas, so there is still some international exposure in my non-super investments, but in an attempt to even things out a little overall everything in Super will be International. The franking credit free kick is really important when I retire, but by the time I can access my Super it won’t matter so much.

Reasons I might be wrong:

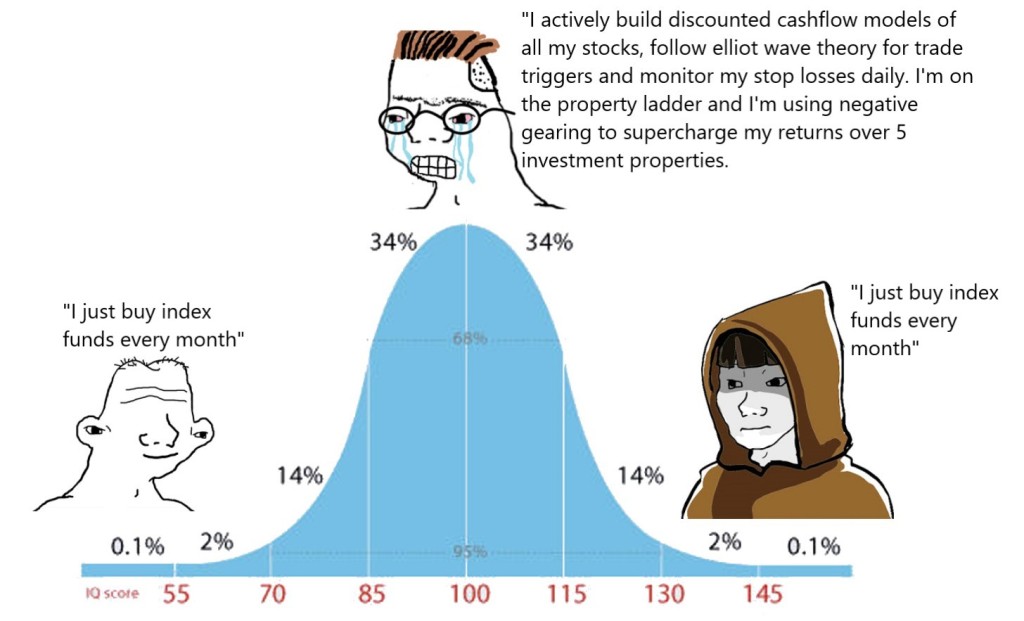

A good mate of mine, John Keynes once said, “It is better to be roughly right than precisely wrong.”

So I try not to over optimise anything, especially something that isn’t an exact mathematical relationship. If you’re making good progress in the right direction it’s probably going to be ok in the end. Compound interest will probably look after the rest. I’ve clearly favoured regular payments of dividends over my previous approach of a mix of diversified index funds bonds and selling down as per the 4% rule, made famous by Bengen. To me it feels nicer not to sell any of my nest egg, even though selling under 4% each year shouldn’t deplete it as outlined in Bengens link above. But in taking this approach I’ve gone slightly against the conventional wisdom, and I owe it to myself and to any readers to point out where I could be wrong:

- As pointed out by a mate of mine Shane, previously one of the political parties in Australia tried to change the treatment of franking credits. Apparently this was aimed at fixing an inequality they saw in the superannuation system. I need to explain what franking credits are here for this to make sense. When you own shares, you are an owner of that company. When you own shares in an index fund, you are an owner of many companies. As an owner of a company you also own the profits of the company. Some companies, at their owners request, pay the owners a certain percentage of the profits as a dividend. So the next question is what’s a profit? Well, that’s the roughly company revenue, minus expenses and tax is paid on the remainder at the company tax rate of 30%. So a franking credit is to take into account, that a 30% tax has already been paid on that profit and subsequent dividend. So when you pay income tax, the dividends are taxed at your marginal tax rate and you only have to make up the gap between 30% and your marginal rate on the dividend income. Or if your marginal tax rate is below 30% you’ll get a tax return. The change was to remove the ability to get a tax return if your marginal tax rate was below 30%. This to me seems a little silly, as it will mean some earnings are taxed twice, and it will be taxing people who have a marginal tax rate of below 30% (who are on low income earners) more than those with a marginal tax rate above 30%. So it’s definately a risk, but I’m happy to take it. I think it’s likely if this change does happen, that investors will favour investing in international shares over Australian shares and share prices will go down, which will in effect increase the non-franking credit dividend yield somewhat. If you’re still buying shares it may not affect you so much, but if you’ve stopped buying shares and this changes the lack of the franking credit tax refund will mean a reduction in total income.

- According to all the investing books, this isn’t the optimal approach. You shouldn’t favour Australia so much, and you should also have a certain percentage of your asset allocation allocated to bonds and regularly rebalance betwen your Australian, Internal and bond components to take advantage of the regular change in asset prices between these asset groups. You should also sell down your portfolio over time at 4% a year or less and it should last foreverish. There’s a lot of books and a lot of research on this, and if I was giving advice (I’m not) I’d have to say go with what the books say. But for me, I really like the approach of not having to sell anything, not having to rebalance, having a regular dividend payment most months of the year that should increase over time at a faster rate than inflation.

- I’m sure there’s plenty of other reasons I’m wrong as well.

I should of course say this is not investing advice, just what I’m doing and why, blah blah blah.

As a refresher, here’s the concluding summary of the key points from the original Money, Life, Retirement series from 2017, and a link to the page that you can read the original posts.

And that concludes this rather long winded series of ramblings. As this has been an epic multi-post ramble I’d like to summarise some of the key points for emphasis:

- Money is a direct result of a bargain you make with your employer to hand over a very large portion of your life. In effect it’s special paper life force tokens you can exchange with other people for other things.

- Your life, and by association money, is not a renewable resource, it is finite.

- There is a counterparty to every transaction and they are only entering into the transaction because they think it will be beneficial to them. By inversion it will probably be net negative for you.

- Due to hedonic adaption you shouldn’t spend large amounts of your paper life force tokens on things that make you temporarily happy that you will become used to and don’t increase your happiness in the long term. You should invert and spend your paper life force tokens taking things out of your life that make you unhappy.

- By committing to full time employment you’ve actually limited the time you are free to be in control of your life to only 2 days a week. Two days a week is but wafer thin Monsieur. Only when you’re in the position where you don’t have to work is any choice to commit to full time employment valid, up until that point it’s a decision made under compulsion.

- To optimise anything you need a feedback loop. Measuring and reflecting upon your expenses per category each month is a feedback loop that will allow you to optimise your spending so that you are not spending more on things that do not make you happy.

- If your salary gives you a certain amount of dollars per month, by tracking your expenditure per month you can invert that relationship and work out the number of months per dollar. You can then work out the conversion rate between the price of things and the amount of your life you are trading for that thing.

- The amount of money needed for indefinite retirement equals your yearly expenses divided by the safe withdrawal rate.

- It’s been shown historically that a 4% withdrawal rate could probably last indefinitely with a 75% stock, 25% bond mix.

- The most important thing that determines the amount of time until you can retire is your savings ratio. With a 4% withdrawal rate, no current savings and a 7% assumed return a savings ratio of 50% means you can retire in 15 years, a savings ratio of 75% means you can retire in 6.8 years.

- People are generally bad at relating short terms actions to long term consequences. In order to get to a point where you can buy your freedom you should forecast your plan to financial freedom and track every expense to turn that forecast freedom into actual freedom.